Information Disclosure Based on TCFD Recommendations

Endorsing and Addressing the TCFD Recommendations

In January 2020, NSK endorsed the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. In accordance with the recommendations of the TCFD, NSK identifies business risks and opportunities, adapts management plans, and enhances information disclosure with the aim of contributing to both the sustainable development of society and the sustainable growth of NSK, while endeavoring to take its environmental activities to the next level.

Climate-related Governance

NSK has adopted a Company with Three Committees (Nomination, Audit, and Compensation) as its form of corporate organization. As part of this organization, the Board of Directors proactively delegates decisions regarding the execution of operations to the executive organizations and monitors the status of execution in an appropriate manner. Under the direction of the CEO, executive officers are responsible for executing their respective duties in accordance with their division of duties. The Mid-Term Management Plan is decided by the Board of Directors, which monitors the Plan’s specific measures implemented by the executive organizations, as well as the progress of these measures.

Established in FY2022 and chaired by the CEO, the Core Values Committee specifies Group-wide issues through the discussion of policies for promoting and enhancing the core values of safety, quality, environment, and compliance, and through the sharing of climate-related risks. This Committee also provides suggestions for and monitors the progress of solutions to these issues.

Climate-related Risk Management

NSK works to build a risk management system based on clearly stipulated fundamental principles aimed at effectively enabling global Group management and internal control functions. Every year, NSK classifies, analyzes, and evaluates risks to identify the risks that should be addressed. These risks are then managed in accordance with the prescribed reporting systems.

NSK has for some time treated climate-related risk, which is among the risks associated with the environment, across businesses or divisions as a risk of high importance. However, NSK is now analyzing changes in the business environment and impacts on its business by making use of the scenario analysis recommended by the TCFD and has been enhancing efforts to identify issues and implement countermeasures, among other initiatives.

Strategy

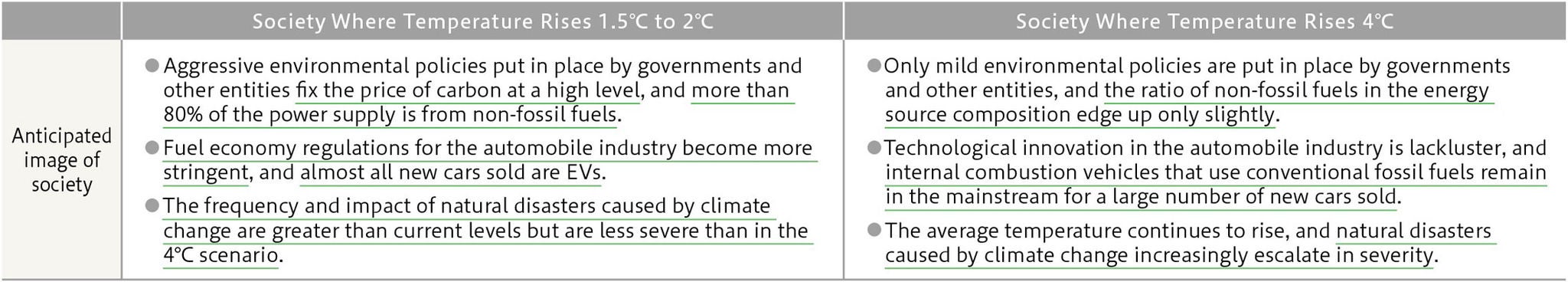

With the goal of considering the future impact that climate change will have on NSK’s value chain, as well as the effectiveness of climate change countermeasures, NSK looked at the period up to the year 2050 and performed two scenario analyses, one scenario with a temperature increase of 1.5℃–2℃ and another scenario with an increase of 4℃. As a result of these analyses, NSK determined that its basic strategy is to contribute to realizing a sustainable society in which the global temperature rise can be kept under 1.5℃–2℃. In short, NSK will act to address transition risks associated with CO2 emission regulations; recognize the needs of society, namely decarbonization throughout product life cycles, as opportunities to advance its business field of Motion & ControlTM; and promote measures to address climate change through its overall business activities. On the other hand, NSK will promote measures considering the scenario analyses results for natural disasters that are caused by climate change.

Scenario Analysis

■ Analysis targets and prerequisites

■ Image of anticipated 2050 society in which NSK operates its business for the scenario analysis (outline)

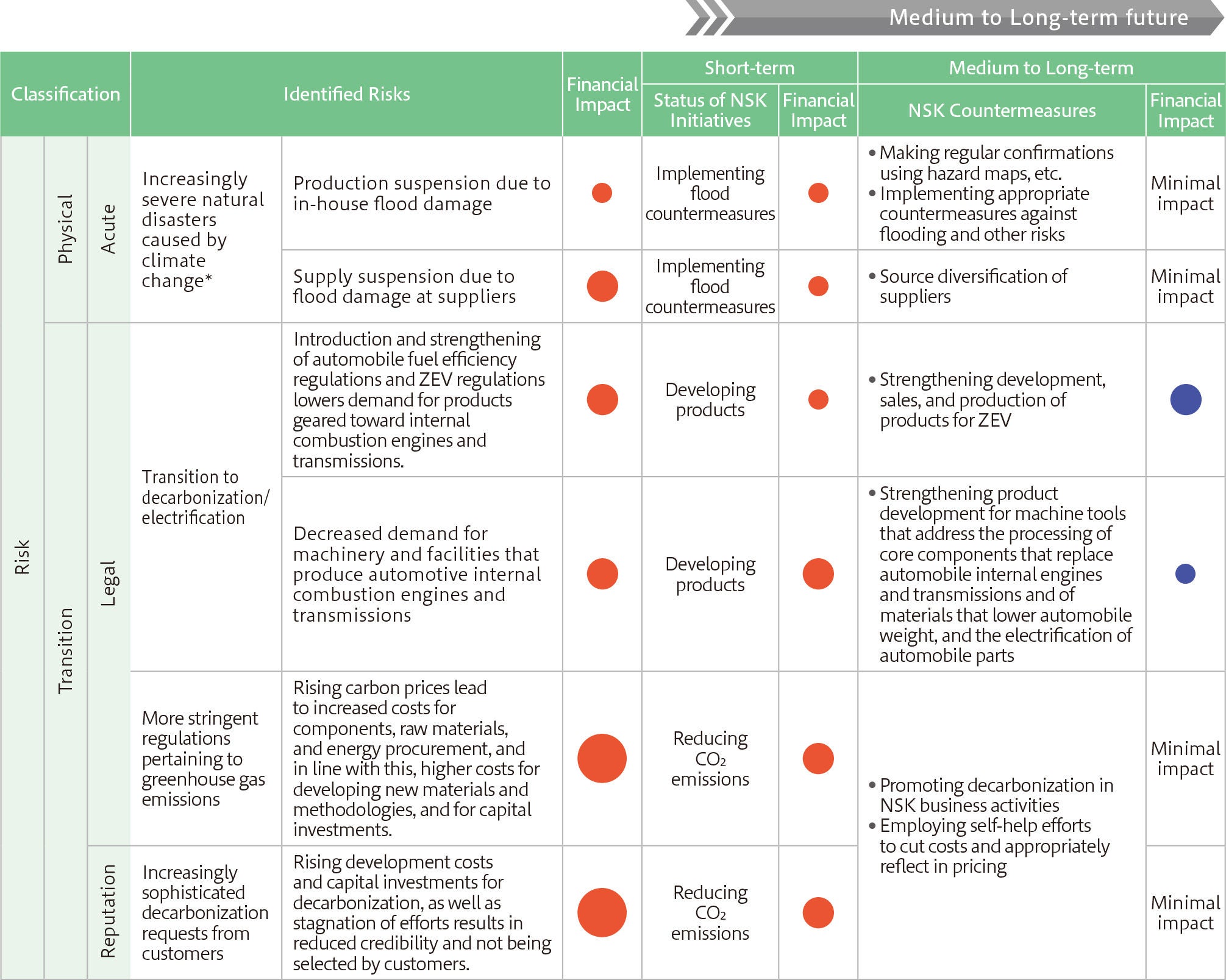

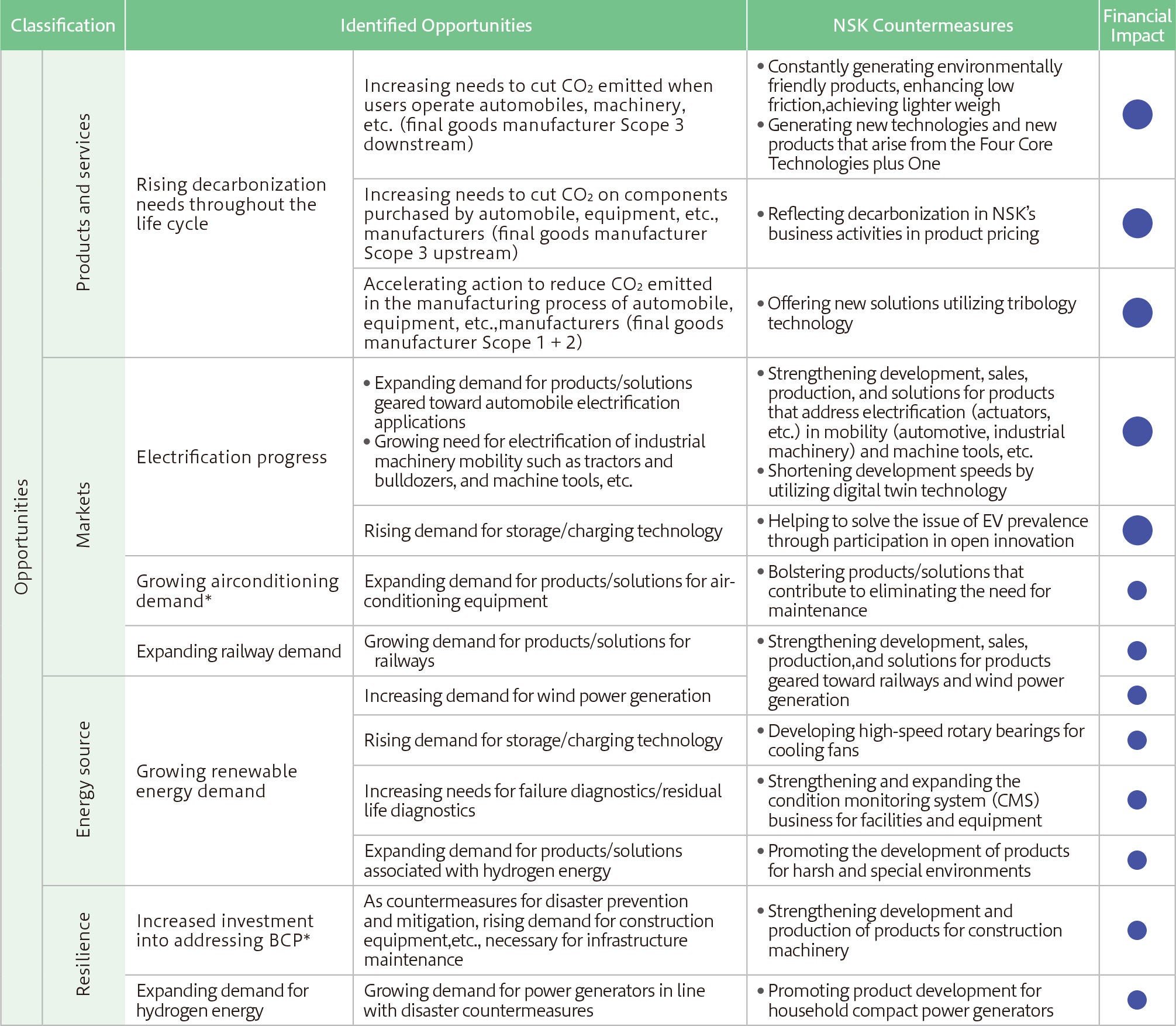

Risks and Opportunities

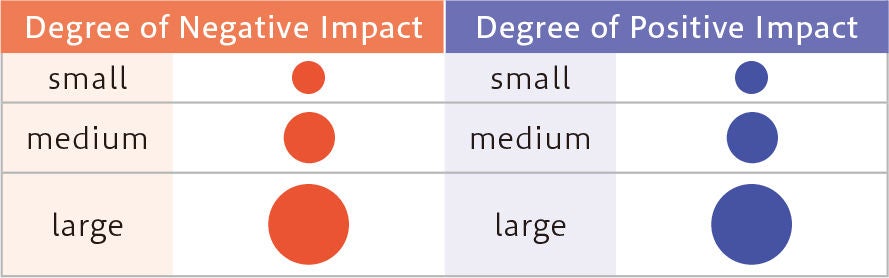

Financial impact is indicated as negative (red) or positive (blue) impact on the business, and and the size of the circle indicates the scale of the impact.

When there is almost no impact, it is indicated as "Minimal impact."

Forecast of Risk from Response Measures

Opportunities

Created based on the 1.5℃ to 2℃ scenario. However, * is assumed to be for a 4℃ scenario.

In estimating the financial impact, the risk of inundation, the number of days of outages and damage due to inundation, and the projected carbon tax price are calculated using data published by public agencies.

Metrics and Targets

NSK has set long-term targets and is advancing initiatives through the dual approach of cutting CO2 emissions from business activities and expanding on the volume of CO2 emissions avoided by using environmentally friendly products. Particularly in terms of reducing CO2 emissions from business activities, NSK has established a target of effectively reducing Scope 1 and 2 CO2 emissions to zero by FY2035 under MTP2026, which kicked off in FY2022. This CO2 emission reduction target is consistent with improving corporate value and is used as an indicator for executive officer short-term performance-based compensation.

Reductions in CO₂ Emissions from Business Activities (Scope 1 and 2)