Corporate Governance

Corporate Governance

Basic Policy

The NSK Mission Statement is as follows: “NSK contributes to a safer, smoother society and helps protect the global environment through its innovative technology integrating Motion & Control™.” As a truly international enterprise, we are working across national boundaries to improve relationships between people throughout the world. NSK Ltd. aims to fulfill this responsibility to society while maintaining an appropriate level of profitability that meets the expectations of our shareholders, thereby achieves sustainable growth and increases our mid- to long-term corporate value.

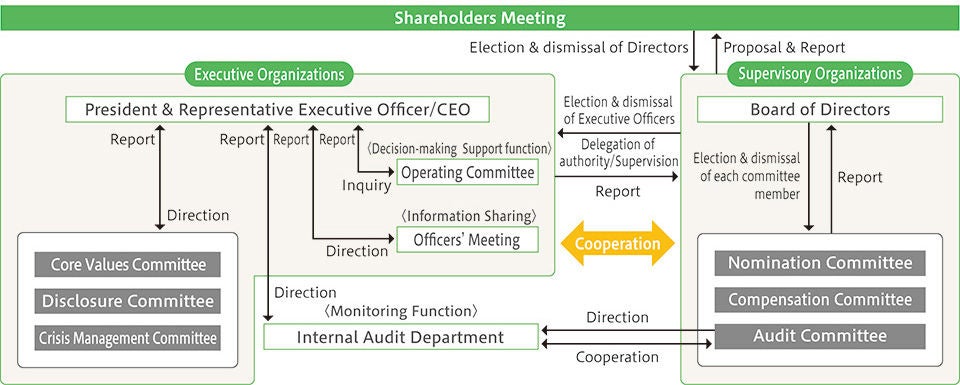

NSK believes that the establishment and maintenance of systems that ensure transparent, fair and timely decision-making is essential in order to achieve sustainable growth and increases our mid- to long-term corporate value. To realize this objective, we are working to construct our corporate governance systems based on the following four guiding principles.

We aim:

(1) To increase the efficiency and agility of management by proactively delegating decision-making on the execution of the operations from the Board of Directors to the Company’s executive organizations.

(2) To ensure that supervisory organizations have oversight of executive organizations by clearly separating the two.

(3) To strengthen supervisory organizations’ oversight of the executive organizations by ensuring cooperation between the two.

(4) To improve the fairness of management by strengthening compliance systems.

NSK has adopted a Company with Three Committees (Nomination, Audit and Compensation) as its form of corporate organization to better achieve the aforementioned basic approach. We have articulated this basic approach to corporate governance and its structure in our Corporate Governance Rules, which guide directors and executive officers in the performance of their duties.

Corporate Governance Structure

Core Values Committee: The core values of "Safety, Quality, Environment, and Compliance" are common value standards that are given the highest priority in NSK's management decisions and actions. The Core Values Committee promotes the Company's sustainability activities by discussing policies for promoting and strengthening core values and sharing related risks, establishing company-wide issues, making recommendations for their resolution, and monitoring progress.

Supervisory Organizations

NSK's Board of Directors passes resolutions related to basic management policies etc. The Board also delegates decision-making on the execution of the operations to executive organizations, while monitoring the status of implementation in an appropriate manner. A list of the items which must be resolved by Board of Directors is as follows.

<Major matters requiring board resolution>

- Basic management policy

- Matters regarding the interrelationship between the Executive Officers, including the division of duties between the Executive Officers and hierarchy of command of the Executive Officers

- Basic policy on the development of internal control systems

- Acquisition of company treasury stock stipulated in the Articles of Incorporation

- Calling of the General Meeting of Shareholders

- Approval of related party transactions

- Appointment and removal of members of the Nomination, Audit and Compensation Committees

- Appointment and removal of the Executive Officers

- Appointment and removal of Representative Executive Officers

- Approval of financial statements, business reports and the annexed detailed statements thereof as well as provisional financial statements and consolidated financial statements

- Decision on matters regarding dividends of surplus stipulated in the Articles of Incorporation

- Approval of execution of material operations

- Establishment, amendment and repeal of material by-laws

- Other items required to be resolved by the Board of Directors in accordance with laws or the Company's Articles of Incorporation except matters which may be delegated to the Executive Officers as well as items delegated to the Executive Officers but for which resolution of the Board are deemed necessary

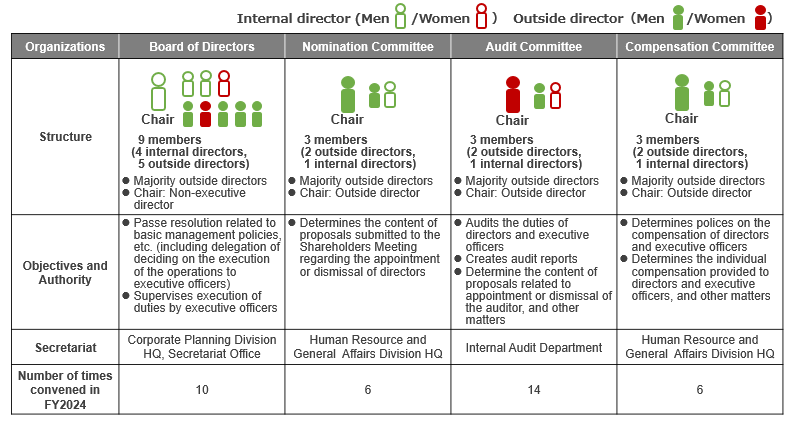

The Nomination Committee, Audit Committee and the Compensation Committee, each of which are comprised of a majority of independent outside directors, work to strengthen the monitoring function by fulfilling the duties of each.

Nomination Committee

The primary function of the Nomination Committee is to determine the content of proposals regarding the election and dismissal of directors to be submitted at the general meeting of shareholders, ensuring with due care that the nominating process for director candidates is transparent and effective.

Audit Committee

The primary function of the Audit Committee is to audit the execution of duties by the Directors and the Executive Officers and prepare audit reports, as well as to determine the content of proposals regarding the election and dismissal of financial auditors. The Committee also audits in accordance with the Companies Act, and the NSK Group's governance systems and its management of business risk in cooperation with the internal audit department.

Compensation Committee

The primary function of the Compensation Committee is to determine the remuneration policy for the Directors and the Executive Officers as well as the remuneration of the individual Directors and Executive Officers.

Executive Organizations

The Executive Officers appointed by the Board of Directors are responsible for executing their respective duties in accordance with the division of duties under the directions of the Chief Executive Officer (CEO) . NSK established the Operating Committee and Officers' Meeting, and secures the efficiency and agility of execution of operations properly.

Operating Committee

The Operating Committee is established as an organization for supporting decision-making by the CEO. It deliberates on policies and key matters relates to the execution of the NSK Group's business operations.

Officers' Meeting

The Officers' Meeting is established to foster a common understanding by sharing information of managerial issues, operational direction and status of the execution of their duties. The Officers' Meeting consists of the CEO, Executive Officers, Operating Officers and Group Officers, and is chaired by the CEO.

Internal Control System

The Executive Officers are required to create and operate internal control systems, according to the basic policy determined by resolution of the Board of Directors. The main functions of the internal control system and the roles of the organization responsible are outlined as follows:

Compliance

The Legal & Compliance Division shall formulate policies to strengthen the Group's compliance system, implement various measures based on these policies, continuously monitor the status of these policies, and regularly report its activities to the Core Values Committee.

Risk Management

The Corporate Planning Division Headquarters coordinates with each business, functional and regional headquarters and oversee and manage general risks related to management of the NSK Group. It is also responsible for maintaining and enhancing the internal control systems necessary for the risk management.

The Crisis Management Committee oversees the NSK Group's business continuity management efforts, anticipate the materialized risks that the NSK Group may encounter, and promote preparedness in normal times to minimize damage. In the event that a risk is materialized, the committee cooperates with related departments and direct and control prompt and accurate actions.

Approval and Reporting

Each NSK Group company must duly apply to the CFO for approval on matters related to corporate management, systems, the governance structure, and shareholder interests, or to the controlling business or functional division headquarters in the case of important decisions related to business operations. NSK Group Companies must also report on the status of their operations to the Company on a regular basis.

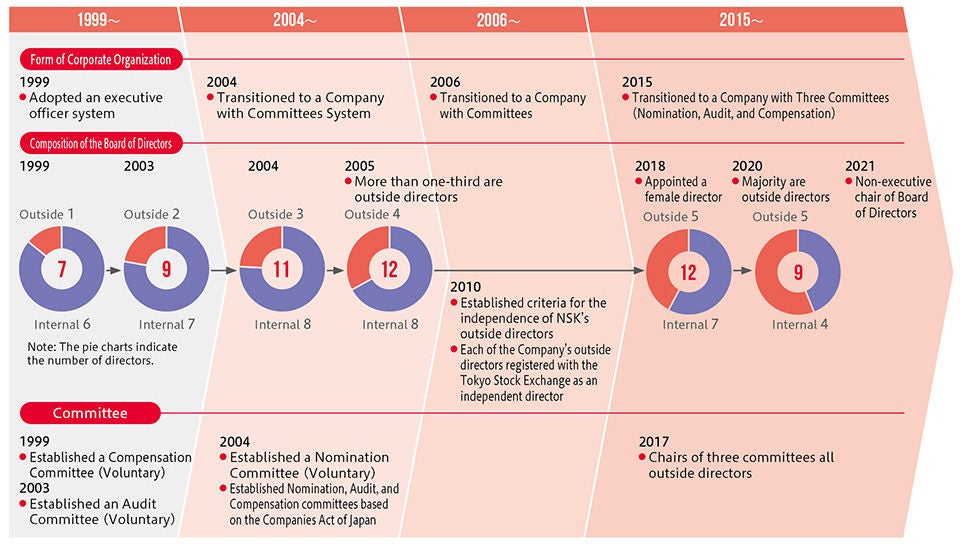

Changes to Corporate Governance System

Response to Japan’s Corporate Governance Code

NSK complies with all principles of the Corporate Governance Code and outlines its policies in the Corporate Governance Report that it submits to Tokyo Stock Exchange, Inc.

Board of Directors

Composition of the Board of Directors

The Company believes that its Board of Directors should be well-versed in the Company’s businesses and be capable of supervising important managerial judgments related to business execution, with the aim of enhancing the sustainable growth and mid- to long-term corporate value of the NSK Group. Career diversity in field of expertise and business experience are considered to ensure that the Board maintains a well-balanced composition, in light of the Company’s mid- to long-term business strategy or managerial issues, and the size of the Board is also considered to enhance the effectiveness of deliberations. In appointing individual directors, we seek directors who possess not only experience and insight in general business management or in their respective areas of expertise, but also high ethical standards as corporate leaders, along with a deep understanding of corporate governance, risk management and global business operations.

For reference, we expect each director to have skills, expertise, and experience of corporate management, finance/accounting capital policy, engineering/manufacturing, digital, sustainability to strengthen its supervisory function in promoting and achieving the Company’s management philosophy and mid-term management plan, and outlines the expected roles of directors.

| Corporate governance | We believe that establishing an appropriate governance structure is necessary and important for the Company to continue its global business expansion and to enhance the effectiveness of management oversight throughout the Group. |

| Risk management | In order to enhance corporate value and achieve sustainable growth, we believe it is important to establish and operate internal controls through proper and efficient business execution, as well as to manage various risks related to our business. |

| Global business operations | Since we have operated on a global scale and appropriately incorporated geopolitical development, economic conditions, policy directions and market trends into our management and business strategies, we believe that experience and insight in this field are important. |

| Item | Reason for selecting the item |

|---|---|

| Corporate management | In order to properly supervise business execution, we believe it is necessary for Directors to have experience in business operations as a top executive, knowledge of corporate reform, and a background in corporate management that enables appropriate risk-taking and prompt, decisive decision-making by the Company's management team. |

| Finance/Accounting Capital policy | We believe it is necessary to make management decisions that take into account the improvement of profitability and capital efficiency, based on appropriate capital allocation from a management perspective. |

| Engineering/Manufacturing | We believe it is necessary to have management strategies aligned with technological advancements and changes in the business environment, as well as knowledge of technological trends, including new fields and domains, and manufacturing, including safety and environmental considerations. |

| Digital | We aim to leverage digital technologies to enhance our managerial resources. To properly monitor the evolution of digital technologies and the business operations that utilize them, we believe that experience and expertise in the digital field are necessary. |

| Sustainability | We believe it is necessary to enhance corporate value through management that takes into consideration sustainability with respect to the environment and societal issues such as human rights, human resource development and diversity. |

| Name | Skills, experience and expertise expected | Expected Roles of Outside Directors | ||||

|---|---|---|---|---|---|---|

| Corporate Management | Finance/ Accounting/ Capital Policy | Engineering/ Manufacturing | Digital | Sustainability | ||

| Akitoshi Ichii | * | * | * | |||

| Keita Suzuki | * | * | * | |||

| Kenichi Yamana | * | * | ||||

| Ruriko Yoshida | * | * | ||||

| Junji Tsuda | * | * | Management strategy | |||

| Sayoko Izumoto | * | * | Finance/Accounting, Internal Control Systems | |||

| Mikio Fujitsuka | * | * | * | Management strategy, Finance/Accounting | ||

| Nobuhide Hayashi | * | * | * | Management strategy, Capital Policy | ||

| Akira Kashima | * | * | * | Finance/Accounting, Internal Control Systems | ||

Junji Tsuda, Sayoko Izumoto, Mikio Fujitsuka, Nobuhide Hayashi and Akira Kashima are outside directors.

Structure and Roles of Supervisory Organizations

(As of the end of June, 2025)

Years as Director at NSK, Attendance at the Board of Directors and Committee meetings

(As of the end of June, 2025)

| Name | Years as Director at NSK | Attendance at the Board of Directors and committee meetings (FY2024) | Current position of the Board | Significant Concurrent Positions outside the Company | ||

|---|---|---|---|---|---|---|

| Akitoshi Ichii | 8 | Board of Directors | 100% | (10/10) | Member of the Nomination Committee | - |

| Nomination Committee | 100% | (6/6) | ||||

| Keita Suzuki | 2 | Board of Directors | 100% | (10/10) | Member of the Compensation Committee | - |

| Compensation Committee | 100% | (6/6) | ||||

| Kenichi Yamana | 4 | Board of Directors | 100% | (10/10) | - | - |

| Audit Committee | 100% | (14/14) | ||||

| Ruriko Yoshida | - | - | Member of the Audit Committee | - | ||

| Junji Tsuda | 3 | Board of Directors | 100% | (10/10) | Chair of the Nomination Committee | Senior Advisor of Yasukawa Electric Corporation Outside Director of TOTO LTD. |

| Nomination Committee | 100% | (6/6) | ||||

| Sayoko Izumoto | 3 | Board of Directors | 100% | (10/10) | Chair of the Audit Committee | External Audit and Supervisory Board Member of Freund Corporation Outside Director of Tokyo Keiki Inc. |

| Audit Committee | 100% | (14/14) | ||||

| Mikio Fujitsuka | 2 | Board of Directors | 100% | (10/10) | Member of the Nomination Committee | - |

| Nomination Committee | 100% | (6/6) | ||||

| Nobuhide Hayashi | 1 | Board of Directors | 100% | (8/8) | Chair of the Compensation Committee | Advisor of Mizuho Financial Group, Inc. Auditor of JTB Corp. Outside Audit & Supervisory Board Member of Tobu Railway Co., Ltd. |

| Compensation Committee | 100% | (5/5) | ||||

| Akira Kashima | - | - | Member of the Audit Committee | - | ||

| Member of the Compensation Committee | ||||||

* Ruriko Yoshida and Akira Kashimai were newly appointed as directors on June 25, 2025, and therefore have not attended any meetings in fiscal 2024.

* Each of the outside directors has been registered with the Tokyo Stock Exchange as an independent director.

Outside Directors

Roles and Election Standards of Outside Directors

NSK expects outside directors to possess outstanding character and a broad range of knowledge. These individuals provide expert knowledge beneficial to the Group and contribute to achieving sustainable growth and increasing its mid- to long-term corporate value.

When electing outside director candidates, we verify requirement as follows in addition to “Selection Standards of Directors”:

- Persons who have neither a special interest with the Company nor conflict of interest with regular shareholders

- Persons who meet NSK’s criteria for independence

- Persons who have considerable experience and deep insight as a corporate executive or as experts

- Persons who can devote sufficient time to perform duties as an outside director of NSK

The Nomination Committee determines outside director candidates who meet the above criteria.

The following persons are ineligible to become independent director candidates of NSK Ltd.

1) Persons holding positions at a company which constituted 2% or more of the previous year's consolidated sales of NSK, or persons who held such a position until recently.

2) Persons holding positions at a company which made 2% or more of its previous year's consolidated sales to NSK or a subsidiary of NSK, or persons who held such a position until recently.

3) Persons holding positions at a financial institution which NSK relies on for funding, or persons who held such a position until recently.

4) Consultants, accounting or legal professionals receiving significant financial compensation in addition to compensation for the NSK independent director position, or persons who held such a position until recently.

5) Persons belonging to a company or organization which held 10% or more of NSK's total number of shares issued at the end of the most recent financial reporting period, or persons belonging to such a company or organization until recently.

6) Persons belonging to a company or organization which NSK holds 10% or more of the company's total number of shares issued at the end of the most recent financial reporting period, or persons belonging to such a company or organization until recently.

7) Relatives within the second degree, or family members living in the same household as persons specified in items 1) to 6) (excluding non-key posts).("Key posts" are generally assumed to refer to executive or senior managers of relevant companies or trading partners, chartered public accountants belonging to relevant audit firms, and legal professionals belonging to relevant legal firms.)

8) Persons who hold executive positions at NSK or a subsidiary of NSK, or relatives within the second degree or family members living in the same household of persons who held such positions until recently.

The wording “recently” in the items above shall be assumed to be a period of three years or less from the date NSK elects directors.

These criteria satisfy those of the Tokyo Stock Exchange, Inc.

Reasons of Outside Directors Appointment

| Name | Independence | Reasons of Appointment |

|---|---|---|

| Junji Tsuda | * | Junji Tsuda has supervisde management and provide advice on general management from an independent and fair standpoint, drawing on his extensive experience as a corporate manager, high ethical standards, and broad insight, and he has actively participated in Board of Directors meetings. As Chair of the Nomination Committee, he has played a leading role through discussions and deliberations on proposals for the appointment of Directors and CEO succession planning. We believe that he will continue to contribute to improving and strengthening our corporate governance and enhancing our corporate value. |

| Sayoko Izumoto | * | Sayoko Izumoto has supervised management and provide advice on general management from an independent and fair standpoint, drawing on her extensive experience as a certified public accountant, high ethical standards, and broad insight, and she has actively participated in Board of Directors meetings. As the Chair of the Audit Committee, she has played a leading role through discussions and deliberations at committee meetings regarding the enhancement of the audit system and its operation. We believe that she will continue to contribute to improving and strengthening our corporate governance and enhancing our corporate value. |

| Mikio Fujitsuka | * | Mikio Fujitsuka has supervised management and provide advice on general management from an independent and fair standpoint, drawing on his extensive experience as a corporate manager, high ethical standards, and broad insight, and he has actively participated in Board of Directors meetings. As a member of the Nomination Committee, he has played an appropriate role through discussions and deliberations on proposals for the appointment of Directors and CEO succession planning. We believe that he will contribute to improving and strengthening our corporate governance and enhancing our corporate value. |

| Nobuhide Hayashi | * | Nobuhide Hayashi has supervised management and provide advice on general management from an independent and fair standpoint, drawing on his extensive experience as a corporate manager, high ethical standards, and broad insight, and he has actively participated in Board of Directors meetings. As the Chair of the Compensation Committee, he has played a leading role through discussions and deliberations on executive compensation policies and compensation decisions. We believe that he will contribute to improving and strengthening our corporate governance and enhancing our corporate value. |

| Akira Kashima | * | Akira Kashima has supervised management from an independent and fair standpoint, drawing on his wealth of experience as a corporate manager, high ethical standards, and broad insight. We believe that he will contribute to improving and strengthening our corporate governance and enhancing our corporate value by supervising management and providing advice on overall management as an Outside Director. |

Years as Director at NSK, Attendance at the Board of Directors and Committee meetings

Supporting System

NSK provides information in an appropriate manner, including distributing materials to all directors in advance, and prior explanation by officers and the Board secretariat. Furthermore, in previous years, we have provided opportunities for outside directors to visit business facilities in Japan and overseas, which enables them to deepen their understanding of NSK’s business and matters specific to NSK.

In addition, NSK holds meetings comprised of outside directors to facilitate information exchange and foster shared understanding among outside directors and executive officers. While valuing these meetings as an opportunity to freely share opinions, the Board secretariat follows up on requests and suggestions as appropriate to improve the effectiveness of the Board of Directors.

Directors/Officers’ Compensation

Compensation for Directors and Executive Officers, Policy on Determining Compensation Amounts and Calculation Methods

As a Company with Three Committees (Nomination, Audit, and Compensation), NSK Ltd. makes decisions on executive compensation structure, compensation levels, and individual compensation, etc., at a Compensation Committee chaired by an outside director, and based on advice from external consultants as well as objective information on compensation levels and trends at other companies.

The Company will determine compensation for director and executive officer positions separately. When a director also serves as an executive officer, the total of each respective compensation amount shall be paid. For directors who also serve as executive officers, stock-based compensation for the director position will not be provided.

Executive Officers’ Compensation

The compensation package for executive officers consists of a fixed basic compensation and a performance-based compensation that fluctuates with performance. The Company generally sets a compensation ratio of 4:6 of fixed compensation to performance-based compensation.

Executive officer compensation package

(1) Basic compensation

The amount of basic compensation is determined according to the title of the executive officer. Moreover, an additional amount will be paid to executive officers with representation rights.

(2) Performance-based compensation

The performance-based compensation consists of a short-term performance-based compensation and a mid- to long-term performance-based stock compensation.

a) Short-term performance-based compensation

The short-term performance-based compensation are determined based on metrics consistent with management goals to increase profitability, raise efficiency of shareholders’ equity, and improve corporate value: metrics related to the operating income margin, ROE, cash flow, and ratio of new product sales to total sales as well as an achievement target for ESG goals for CO2 emission reductions and safety and quality improvement. The individual’s level of achievement in their designated job duties are also evaluated when determining the amount of compensation paid to each executive officer.

b) Mid- to long-term performance-based stock compensation

In order to further incentivize contributions to a sustainable improvement of corporate value, to ensure they share the interests with shareholders and to further reinforce the link between executive officer compensation and the mid- to long-term stock value, the Company has introduced a performance-based stock compensation program using a Board Benefit Trust system. Through the system, points are fixed every three years based on a relative evaluation of the total shareholder return (TSR) of the Company’s shares through a comparison with the TOPIX growth rate, the equivalent for which Company shares are then distributed upon retirement. However, for a certain portion of the above shall be provided in the from of cash obtained by converting shares into cash.

c) Return of Compensation, etc. (Malus/Clawback Provision)

In the event of a serious compliance violation or revision of the index on which performance linked remuner ation for short term performance based salary or mid to long term performance linked stock compensation was calculated, the Company may request the return of all or part of the performance based compensation via a resolution by the Compensation Committee. In addition, the Company has instituted a mechanism whereby the entire amount of mid to long term performance linked stock compensation may be wi thheld in the event of a serious compliance violation.

Directors’ Compensation

The compensation package for directors consists of a fixed basic compensation and stock compensation which is variable compensation.

(1) Basic compensation

Basic compensation is determined based on whether the director is an outside director or an internal director in addition to the director’s role on committees and the Board of Directors to which the director belongs.

(2) Stock compensation

In order to further incentivize contributions to a sustainable improvement of corporate value and to ensure they share the interests of shareholders, the Company has introduced a stock compensation program using a Board Benefit Trust system. The system distributes company shares upon retirement based on points allocated each fiscal year, of which separate amounts are given for outside and internal directors. However, for a certain portion of the above shall be provided in the from of cash obtained by converting shares into cash. For directors who also serve as executive officers, stock-based compensation will not be provided for the director position.

Other

In addition, in the event a member of a management team of another company such as a subsidiary or an affiliate, etc., assumes an executive officer position, compensation will be determined separately.

Directors/Executive Officers’ Compensation (FY2024)

| Total compensation | Fixed compensation | Performance-based compensation | Stock compensation | ||||

|---|---|---|---|---|---|---|---|

| No. of officers | Amount | No. of officers | Amount | No. of officers | Amount | ||

| Directors (Internal) | ¥95 million | 4 | ¥88 million | - | - | 2 | ¥7 million |

| Directors (Outside) | ¥78 million | 6 | ¥69 million | - | - | 6 | ¥9 million |

| Executive Officers | ¥876 million | 17 | ¥538 million | 16 | ¥116 million | 20 | ¥221 million |

*Compensation (excluding stock compensation) for Directors (Internal) includes compensation for Directors who also serve as Executive Officers.

*The amount of performance-based salary is the planned amount to be paid on July 1, 2025, based on the results for the year ended March 31, 2025.

*The amount of stock compensation is the amount recorded as expenses for the current fiscal year.

*Figures listed above are rounded down to the nearest one million yen.

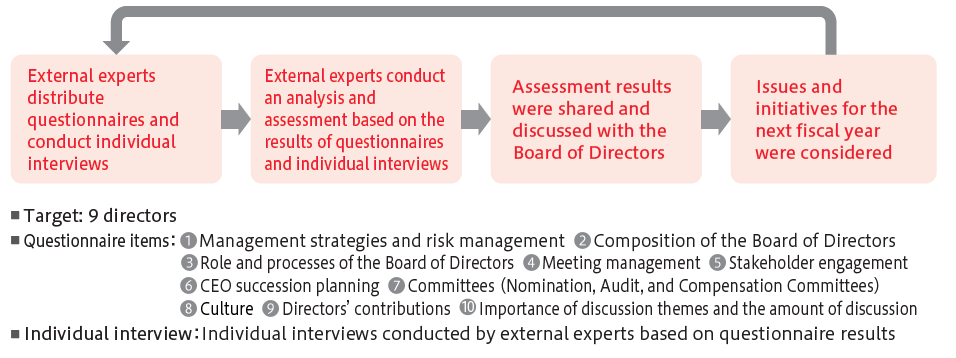

Assessment of Effectiveness of Board of Directors

In order to achieve sustainable growth and increase our mid- to long-term corporate value, NSK conducts annual assessments of the effectiveness of its Board function and works to further enhance performance. To maintain the objectiveness of these assessments, we commission external experts to conduct assessment based on questionnaires and interviews and the results are discussed by the Board.

Assessment Procedures

FY2023 Assessment Results and Future Initiatives

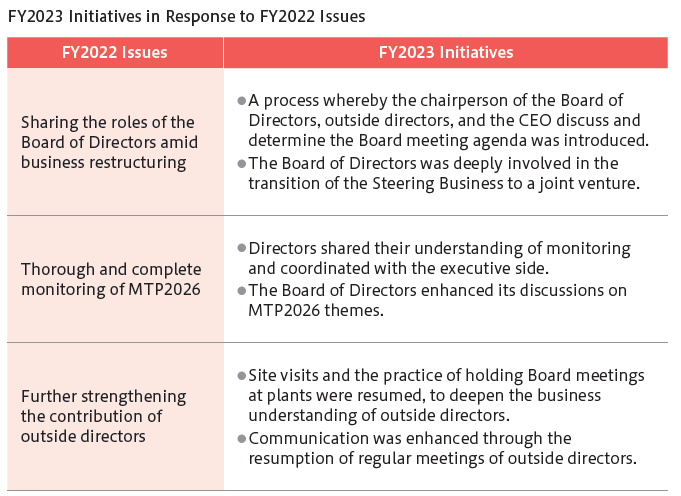

The results of the questionnaire and individual interviews confirmed that the effectiveness of the Board of Directors has improved in FY2023. In particular, the steady progress in confirming the progress of MTP2026 and the enhancement of discussions at meetings of the Board of Directors, such as the Board’s close involvement in the transition of the Steering Business to a joint venture, which was a major decision, were highly evaluated.

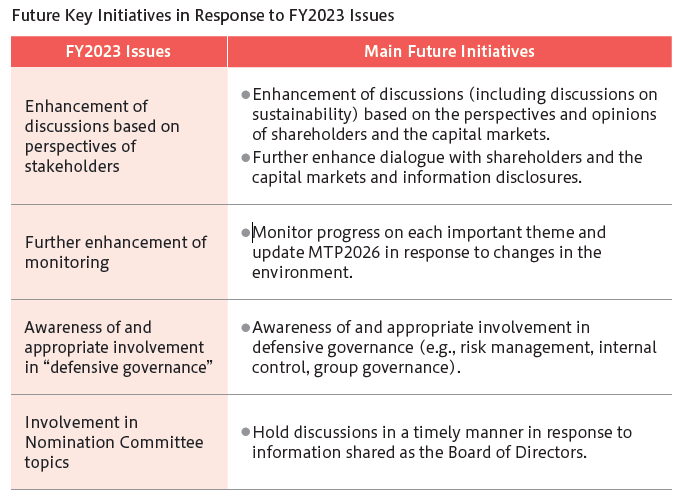

FY2023 initiatives in response to FY2022 issues" and "Future initiatives in response to FY2023 issues" are as follows.

Cross-Shareholdings

Policy on cross-shareholding

In principle, NSK holds no cross holding shares. Conversely, we exceptionally hold cross holding shares in cases where it is deemed necessary to enhance the mid to long term corporate value. Regarding the appropriateness of cross shareholdings, our executive organizations conduct quantitative and qualitative evaluations on an annual basis to determine whether each individual shareholding is delivering acceptable bene fits in relation to our capital cost. The Board of Directors receives regular reports from the aforementioned executive organizations and studies the matter accordingly. We will sell any cross shareholdings whose possession we believe cannot be justified, taking into account stock prices and m arket trends.

As a result, the number of cross shareholdings held by the Company has been reduced by 6 stocks (including 5 listed companies) in fiscal 2024, from 136 stocks (including 79 listed companies) at the end of March 2010 to 46 stocks (including 15 listed companies) at the end of March 2025, a reduction of 90 stocks (including 64 listed companies) over 15 years.

Criteria for exercise of voting rights concerning cross-shareholdings

NSK has defined specific criteria for exercise of voting rights concerning cross-shareholdings. When exercising voting rights, we confirm that the proposal in question does not damage shareholder value, and that it serves to improve the mid- to long-term corporate value of both NSK and the company in which the stake is held. We engage in dialogue, such as requesting explanations, with the company in which the skate is held before determining whether or not we support proposals.

Outside Director Dialogue

For more information on Dialogue with Shareholders and Investors, please click here .